March Market Commentary: In Like A Lamb, Out Like a Lion?

March Recap and April Outlook

Ukraine’s fierce response to and subsequent repulsion of Russian troops surprised everyone, not least Vladimir Putin. As March came to a close, negotiations were beginning to be more realistic, and the evidence on the ground was that Russia was retreating and reassessing.

The Federal Reserve held the monthly FOMC meeting and raised the key short-term interest rate by 25 basis points. What wasn’t expected was Fed Chairman Powell’s subsequent remarks about the pace of rate increases. Powell has worked to be transparent and proactive in communicating the Fed’s intentions.

The change in the pace of rate increases was clear in his language that “There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is what is required to restore price stability.”

Markets interpreted that to mean that 50 basis point hikes would be deployed at the next round because the language change was from raising rates “steadily” in January, which the Fed translated to 25 basis point rate increases.

What Powell is attempting with the return of monetary policy to a “neutral level” is to raise rates as high and as quickly as possible, to take excess liquidity resulting from stimulus out of the system while the labor market continues to be very strong. If further rate hikes are necessary to lower inflation, in theory, the Fed will have more control as it balances rate increases and supporting a growing economy.

The reaction?

Equity Markets: Cool. Growth. We’re Good.

Bond Markets: Not the 50 bps – INVERT THE YIELD CURVE!

The New Recession Obsession

After flirting with the flip for the last week of March, the yield curve inverted on April 1st.

What does this mean?

A normal curve of the different yields related to the maturities of U.S. Treasury securities rises as durations get longer, so the 30-year U.S. Treasury pays a higher yield than the 3-month U.S. Treasury because of the risk of holding the longer-term instrument. The yield curve “flattens” when the spread narrows between a pair of rates, for example, the 5-year and the 30-year. When the shorter-term rate rises above the longer-term rate, the curve is said to “invert.”

Essentially, when short-term rates are higher than long-term rates, bond investors are betting that the economy will slow in the future. Markets appear to think that the Fed will overshoot, stall out the economy, and increase rates all over again.

Why do people that aren’t bond traders care?

When the yield curve inverts for an extended period, a recession tends to follow. Not right away – it’s usually months or even years before the economy catches up to the bond market’s signal of no confidence. But as an indicator, it’s pretty accurate.

What About This Time?

The inversion was triggered by the release of the very strong March employment number. The March non-farm payroll increase was 431,000 jobs, which pushed the unemployment rate to 3.6%, from 3.8%. The fifty-year low unemployment rate is 3.5%, which we hit just before the pandemic. The idea is that the strong labor market means that the Fed will be forced to enact a series of 50-basis point cuts, leading the economy into recession. The significance of the 50-basis point cut is that we haven’t seen one in 22 years. But that’s just one scenario.

Rates all along the curve are not inverted. The Atlanta Fed plots the markets’ expectations for the Fed funds rate. The calculations show a rate that peaks at 3% in the fall of 2023, then drifts slowly downward to 2.5% by the spring of 2025. This looks like the 2019 yield curve inversion, which was followed by some gentle “mid-cycle” rate cuts that worked.

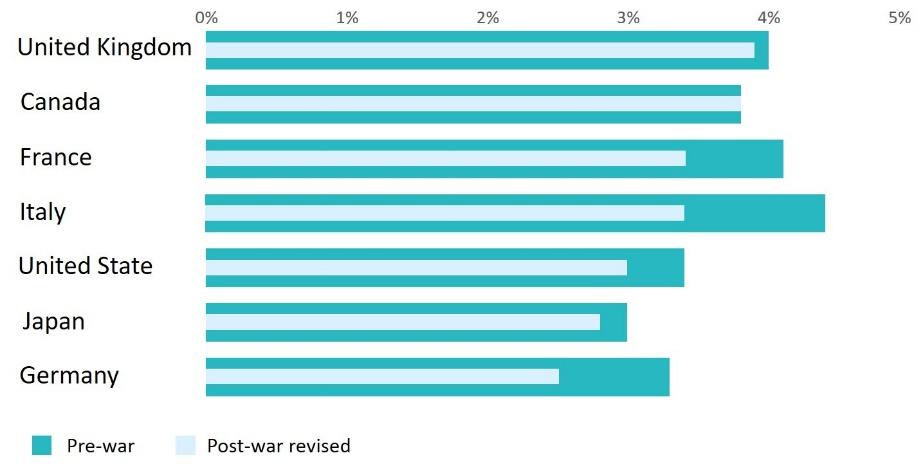

Chart of the Month: GDP Expectations Have Been Revised to Reflect Ukraine

Projected GDP Change in G-7 Countries

Equity Markets

- The S&P 500 was up 3.58% in March, bringing its YTD return to -4.95%

- The Dow Jones Industrial Average rose 2.32% for the month and returned -4.57% YTD

- The S&P Mid-Cap 400 increased 1.21% for the month resulting in a -6.22% YTD return

- The S&P Small-Cap 600 gained 0.18% in March, putting the YTD return at -5.93%

Source: All performance as of March 31, 2022; quoted from S&P Dow Jones Indices.

Volatility is on the increase: In March, 14 of the 23 days posted at least a 1% change while 10 of 19 did so last month, and 8 of the 20 the month before that. Q4 2021 preliminary earnings and sales have not just beat expectations (as they did in Q1, Q2 and Q3 of 2021), but they are setting new quarterly records. For the quarter, 378 (75.6%) have beaten operating estimates. All 11 S&P 500 sectors were positive for the month as the market traded past higher interest rates and inflation, with limited impact from the Ukrainian situation.

Bond Markets

The 10-year U.S. Treasury ended the month at 2.34%, and the 30-year U.S. Treasury ended at 2.45%. The Bloomberg U.S. Aggregate Index was down, returning -2.77. As represented by the Bloomberg Municipal Bond Index, Municipal bonds returned -3.24%. High yield corporate bonds struggled with rising rates, with a return of -1.14% for the Bloomberg U.S. High Yield Index.

The Smart Investor

Volatility is likely to remain elevated. As an investor, this means deploying dollar-cost averaging strategies if you intend to contribute an annual bonus or tax refund to your investment accounts. While the Fed is series about fighting inflation, it will take time. So be sure you have enough cash in your accounts to cover the cost of higher spending.

While your debt has likely already become more expensive, don’t expect interest rates on savings, checking, or money markets account to jump up overnight. Cash is still costing you money, so anything beyond what you need for expenses may be better put to work in other investments.

This isn’t the time to make big changes to your long-term investment plan, but tweaking it may be a good idea. Bond yields aren’t high enough to outpace inflation and rate increases mean the prices of longer-duration bonds are struggling. Reviewing your bond allocation may make sense.