February Market Commentary: Action and Reaction

February Recap and March Outlook

February opened with a strong January employment number as the Bureau of Labor Statistics reported an increase of 467,000 jobs. Instead of reassuring markets after a rough ride in January, it only served to fuel speculation that a strong labor market would lead the Federal Reserve to be more aggressive with rate increases than previously indicated, in its attempts to control inflation. The release of the January average annual inflation number of 7.5% in mid-February proved to be a shock to system.

Overnight, futures markets began pricing in a 50-basis point increase in March, and the two-year U.S. Treasury yield gained 24 basis points. This flattened the yield curve as the ten-year U.S Treasury struggled to get to 2%. The next step after flattening is to invert – which is usually interpreted as a sign of an impending recession. Investors’ worry was that more aggressive Fed rate increases would overshoot and stifle growth.

This was the backdrop as Russia’s saber-rattling in Ukraine, and the West’s telegraphed response of the threat of sanctions, unsettled markets further. And then Russia invaded.

Ukraine Defies Putin, and Defines Heroism

Stiff Resistance Provided a Window for Coordinated Western Action

Ukrainian President Volodymyr Zelenskyy’s reaction to the U.S. offer of help in evacuating his country was the now-famous “I need ammunition, not a ride.” Ukrainian soldiers rejected surrender with “Russian Warship: Go F*** Yourself.” And ordinary Ukrainians stood in front of tanks, or just simply kept going to work, despite the bombs and alarms.

The U.S. and the E.U. responded with incredibly harsh sanctions. The sanctions playbook has been fine-tuned since last fall, and officials in many countries have had time to build the trust needed to impose sanctions that can counteract Putin’s long-honed measures to insulate the Russian economy from the impacts of Russian aggression.

- Western leaders have frozen the assets of Russia’s central bank, limiting its ability to access $630bn of its dollar reserves.

- The US, the EU and UK have also banned people and businesses from dealings with the Russian central bank, its finance ministry and its wealth fund.

- Selected Russian banks will also be removed from the Swift messaging system, which enables the smooth transfer of money across borders. The ban will delay the payments Russia gets for exports of oil and gas.

- Sanctions are targeting Putin personally, and his oligarchs.

The Impact on the U.S.

Have you filled up your gas tank lately? Oil is well over $100 a barrel. As of March 4th, the benchmark Brent and U.S. West Texas Intermediate (WTI) crude futures have soared over 15% to around 10- and 14-year highs, respectively.

Fed Chairman Powell’s testimony to Congress on March 2nd and 3rd was extremely careful to outline the realities that we are likely facing. “The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain. Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways.”

Powell clarified that a 25-basis point increase would be coming in March, and referenced the strong labor market in explaining the Fed’s decision to stay the (cautious) course and raise rates as planned. The release of February’s employment number on March 4th backs this up. The Department of Labor reported that the U.S. added 678,000 jobs in February, and that unemployment had fallen to a pandemic low of 3.8 percent.

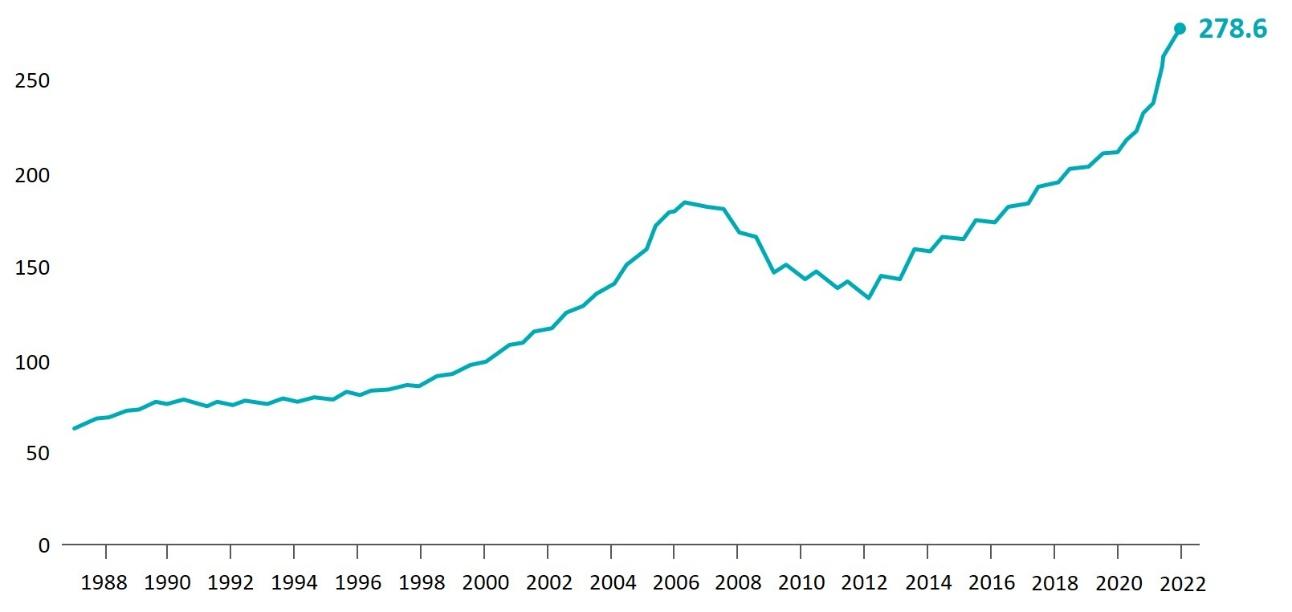

Chart of the Month: Home Prices Are Still Rising

S&P CoreLogic Case-Schiller U.S. National Home Price Index

Equity Markets

- The S&P 500 was down 3.14% in February bringing its YTD return to -8.13%

- The Dow Jones Industrial Average fell 3.53% for the month and was down -6.73% YTD

- The S&P Mid-Cap 400 increased 0.99% for the month resulting in a -6.35% YTD return

- The S&P Small Cap 600 gained 1.30% in November, putting the YTD return at -6.11%

Source: All performance as of February 28, 2022; quoted from S&P Dow Jones Indices.

After posting at least one new closing high for 15 months in a row starting in November 2020, the S&P 500 posted its first official correction since Feb. 27, 2020. For the month, the market was down broadly, as only 1 of the 11 sectors gained, down from 10 last month and 2 the month before that. Energy did the best, as oil continued up, jumping 18.97% for the month. Financials was next, declining a minor 0.08%, down 2.92% for the three-month period and up 35.02% for the one-year period. Going into February, record growth in earnings of 8.7% for 2022 and 9.6% for 2023 were expected.

Bond Markets

The 10-year U.S. Treasury ended the month at 1.82%, and the two-year U.S. Treasury ended at 1.44%. The Bloomberg U.S. Aggregate Index was down, returning -1.11. As represented by the Bloomberg Municipal Bond Index, Municipal bonds returned -0.35%. The high correlation of the high-yield bonds to equities and the market shift to risk-off resulted in a return of -1.02% for the Bloomberg U.S. High Yield Index.

The Smart Investor

Investors have to worry about increased inflation hitting their wallets, and the long-term impact of sanctions on their investment portfolios. Currently, there’s no off-ramp in sight, and sanctions won’t likely be repealed anytime soon. For most investors, however, exposure to Russia may be less of a problem than a prolonged conflict resulting in uncontrollable inflation.

The average international equity fund — an investment portfolio that invests in international stocks — had about 99% of its holdings in places other than Russia, according to Daniel Culloton, a director at Morningstar, as reported by Axios.

By the same token, the labor markets are strong, the recovery is in full swing, and COVID has receded. The strong fundamentals of the U.S. economy, combined with a very careful Fed response, may be enough to keep things on an even keel.

At this point, the response from the E.U., the U.K., and the U.S. governments, and their citizens, is that standing with Ukraine is worth the economic uncertainty.