Five stars 5 stars on Google!

See reviews of our satisfied customers

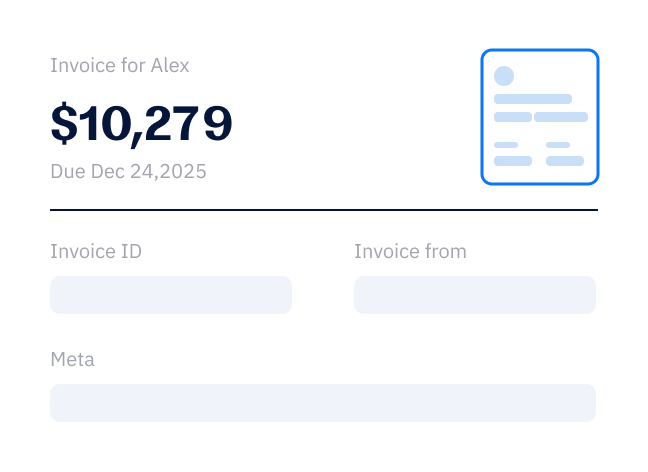

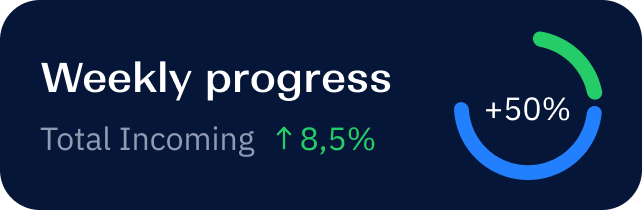

We crunch the numbers while you grow your business

of Business Ownership

Access to CPA network

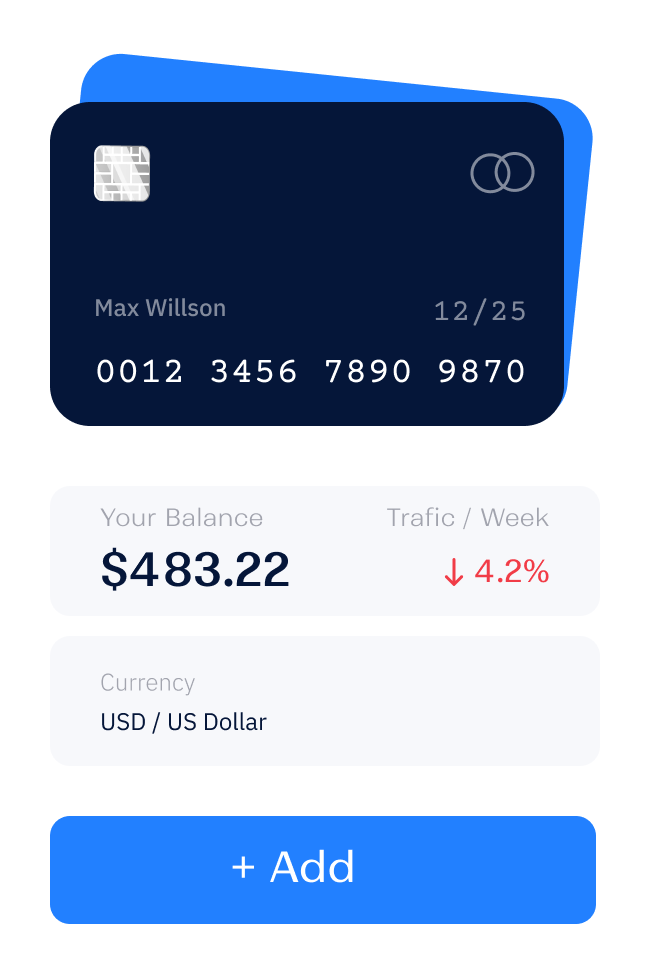

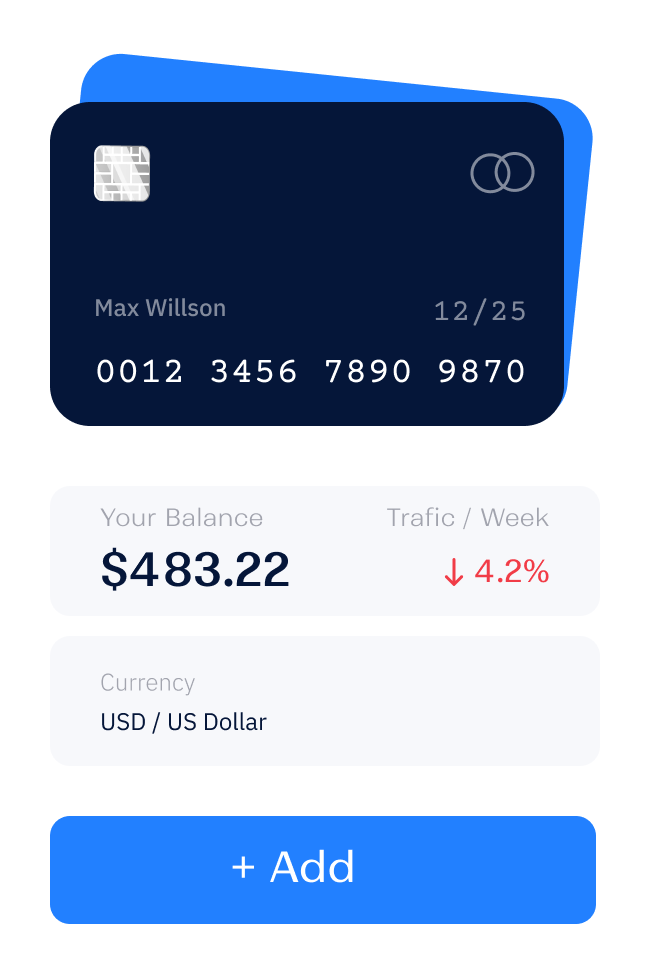

Assets Under Management

How do I manage my resources?

How do I pay less in taxes as an S Corp Owner?

What type of small business retirement plan should I set up?

How much salary should I pay myself?

Review current tax strategies and apply it to your business

Create an income strategy of salary and S Corp dividend bonus

Recommend the best small business plan to maximize your benefit as the owner

Are we a good fit

to meet your needs?

Establishing values,

priorities, and goals

Present the first version

of your financial plan

Review and implement

recommendations

It begins with a plan and ends with a collaborative thinking partner

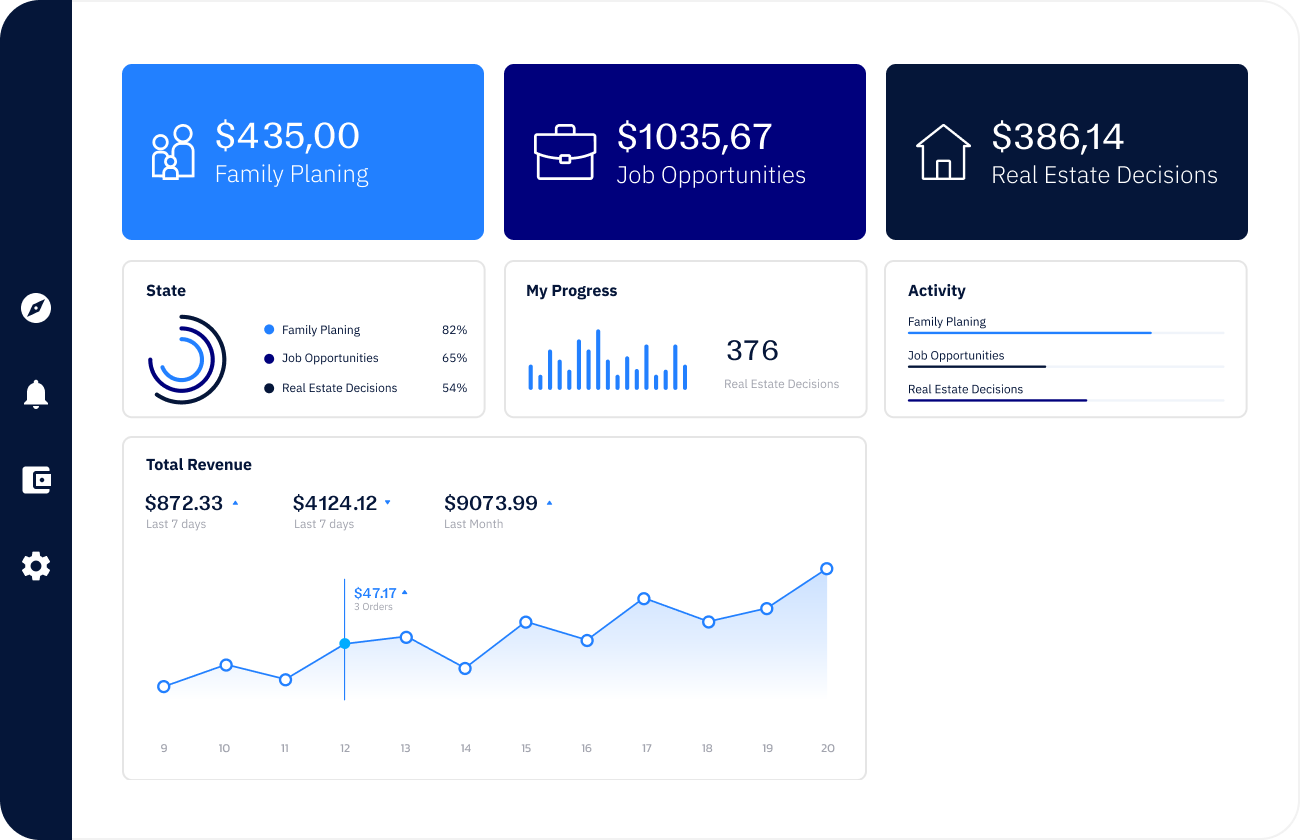

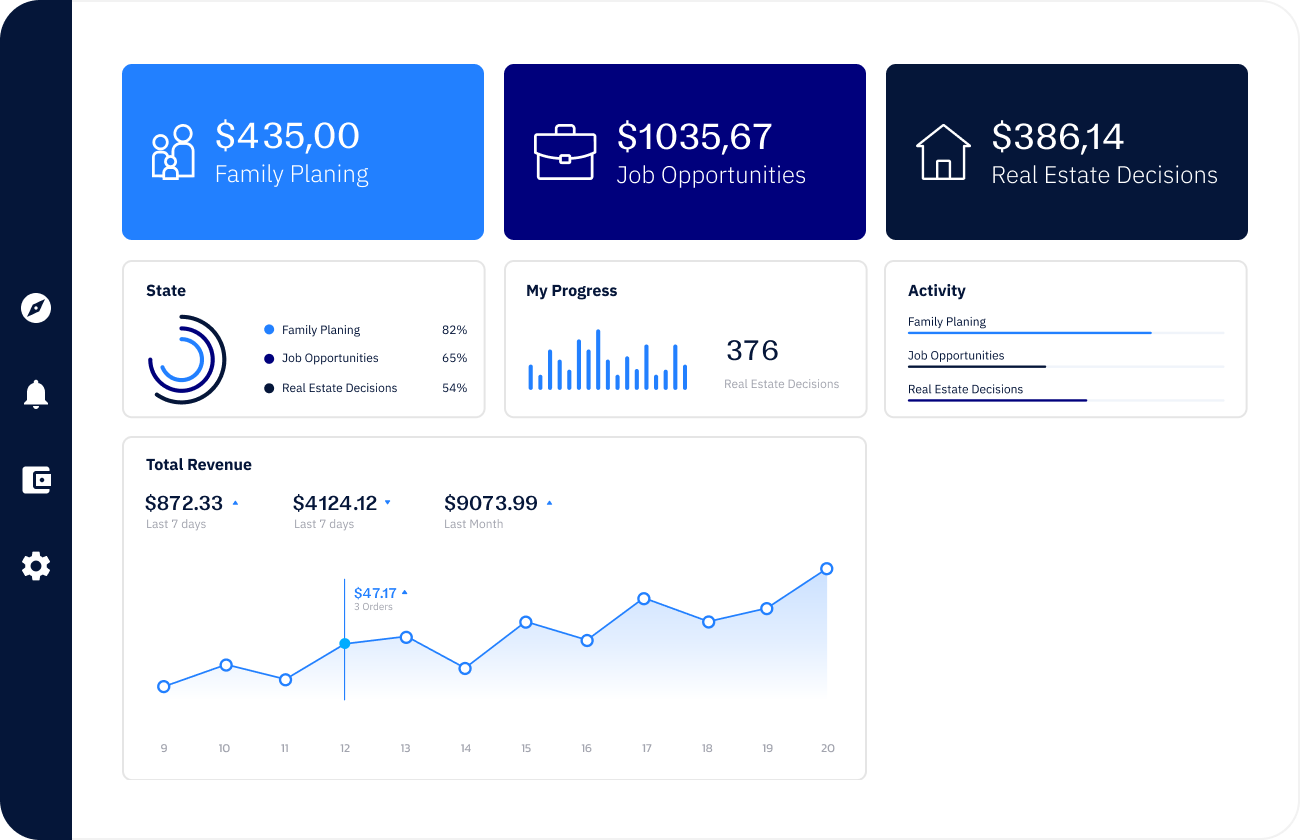

Family Planning

Job Opportunities

Real Estate Decisions

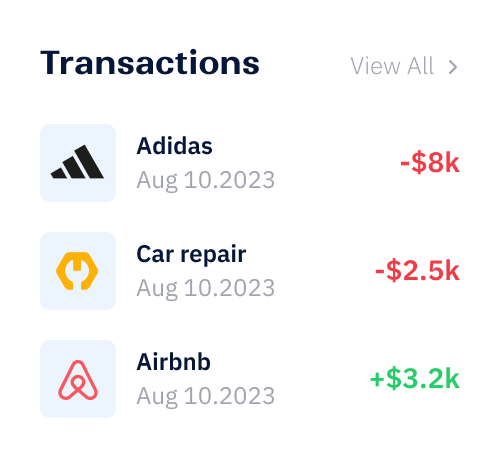

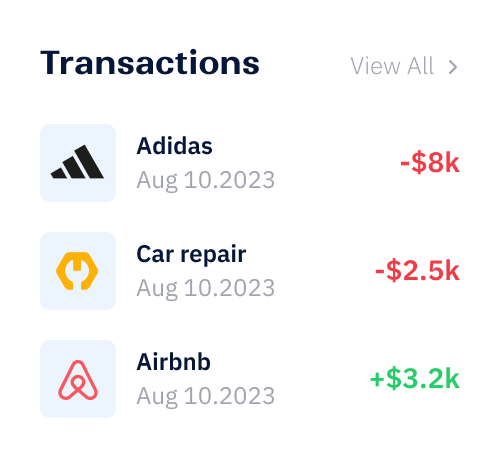

Asset & Debt Management

Cash flow & Income management

Investment Management

Tax Management

Insurance & Benefits Review

Accumulation & Retirement Planning

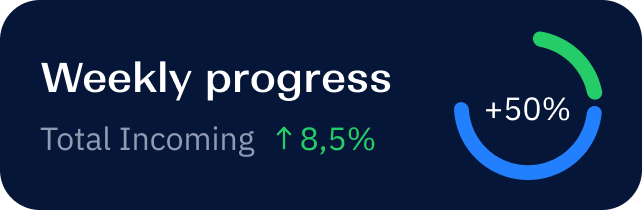

Quarterly check ins

Two review meetings every year

Adjust strategies as opportunities arise

Mark was self employed and didn’t know how

to take advantage of that

Reduced tax bill by $45,000

Lowered his financial independence age by 5 years

Saved $22,000 in taxes using a solo 401(k) plan